DEMAND

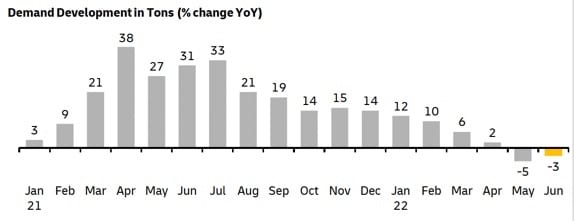

- Volumes are softening in July. Purchasing Index (PMI) is at the lowest level since Aug 2020 resulting in reduced cargo volumes.

- Demand in June was 3% lower than same period in 2020.

- Consumer inflation (highest since 1982) and economic situation makes the outlook uncertain

- There is a comeback in demand as countries exit lockdowns and we’re heading to traditional peak-season – with potential capacity crunch on Asia outbound.

- E-commerce cargo volumes and China resumption in China factory output is expected to be key drivers or increased demand.

CAPACITY

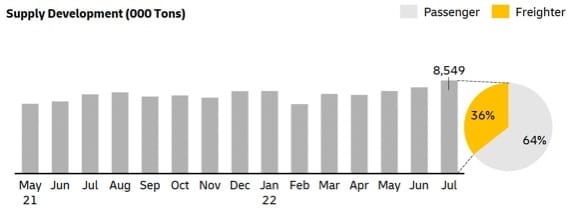

- Incremental improvement in capacity with gradual return of passenger flights – capacity was up 18% in July vs. same period last year.

- Passenger flight capacity down by nearly -19% in Jul 21 vs Jun 19, and overall capacity in the market is down 10%.

- Capacity in and out of China is increasing with the easing lockdown, reaching 80% of pre-lock down levels in June.

- Further increase in passenger flights is expected as more countries is coming out of Covid lockdowns and travel resumes.

- Russia-Ukraine war is continuing to impact the freight market with airspace closure, esp. on North Asia to Europe routes.

RATES

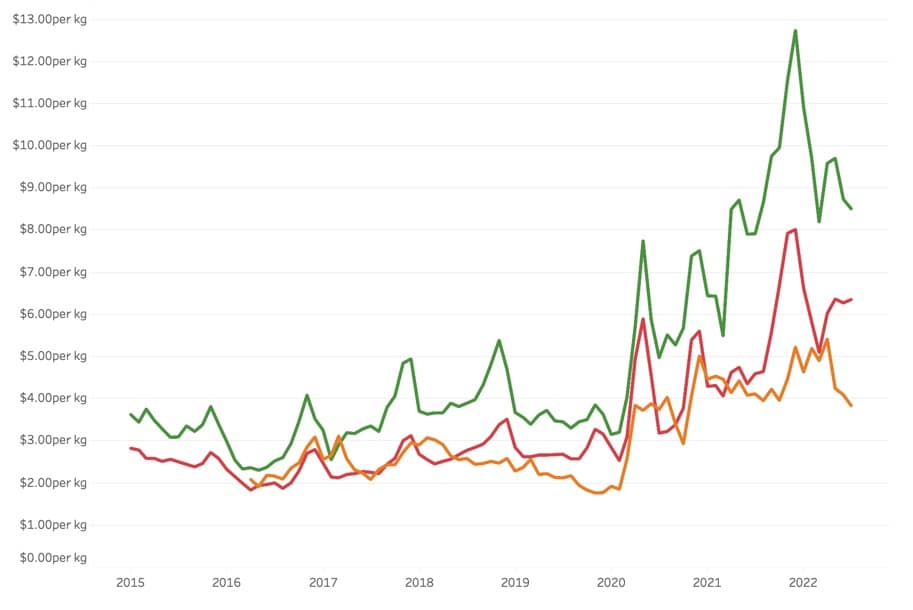

- Rates show signs of softening but in Jun the rates are still 120% higher than same period in ’19 and 23% higher than 2021 baseline.

- Rates are expected to remain high driven by aggressive yield management by carriers, and hike in fuel prices.

- Airlines continue to manage yields aggressively; where cargo revenue is representing 30% of their revenue – compared to 10-15% in 2019

- Priority uplift and direct services comes at a premium – where lower rates risk not getting uplift.

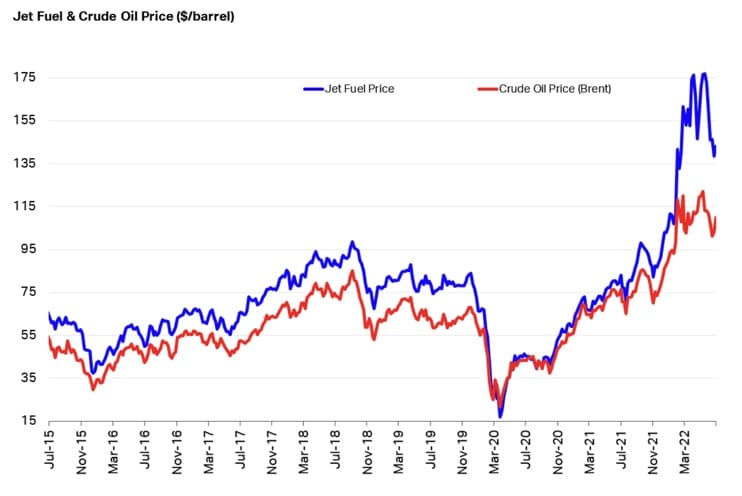

- Jet fuel prices has increased steadily since April 2020 and came in at 159$ per barrel in July.

Demand Updates

- Demand was slowing down in May for the first time since Jan 2021, and continued in June

- With easing lockdowns and increased factory output in Asia, demand is expected to rebound.

- Inflation and energy prices may hinder demand – difficult to predict.

- E-commerce demand and traditional peak-season in Q4 is expected to push volumes higher

Capacity Updates

- Capacity showing positive signs of increasing with resumption in travel and passenger flights.

- If trend continues, this should have a positive impact on stabilising rates and service levels.

- Passenger flight capacity is still down 19% vs. same period last year.

Rates Update

- Rates remain at historically high levels

- Although softening in June and July compared to peak in Q1, rates are still overall higher than 2020 and 2021.

- Highest rate remains on Asia to North America

Jet Fuel Updates

- Jet fuel prices has seen a sharp increase since the war in Ukraine and adds to the total freight.

- Fuel accounts for about 40% to 50% of air operating costs of a single flight.